Things about Hsmb Advisory Llc

Things about Hsmb Advisory Llc

Blog Article

Some Known Details About Hsmb Advisory Llc

Table of ContentsGet This Report on Hsmb Advisory LlcAbout Hsmb Advisory LlcFacts About Hsmb Advisory Llc UncoveredA Biased View of Hsmb Advisory LlcThe Facts About Hsmb Advisory Llc RevealedIndicators on Hsmb Advisory Llc You Should KnowThe Of Hsmb Advisory Llc

Under a degree term policy the face amount of the plan remains the same for the whole period - http://www.askmap.net/location/6879591/united-states/hsmb-advisory-llc. With lowering term the face quantity reduces over the duration. The premium remains the same annually. Frequently such policies are sold as home loan security with the amount of insurance coverage reducing as the balance of the mortgage decreases.Typically, insurance companies have actually not can alter premiums after the policy is sold. Because such plans might proceed for several years, insurance providers need to make use of traditional death, interest and expenditure rate price quotes in the costs computation. Flexible premium insurance, nonetheless, enables insurance providers to supply insurance coverage at lower "existing" premiums based upon much less conventional presumptions with the right to change these costs in the future.

Hsmb Advisory Llc - Questions

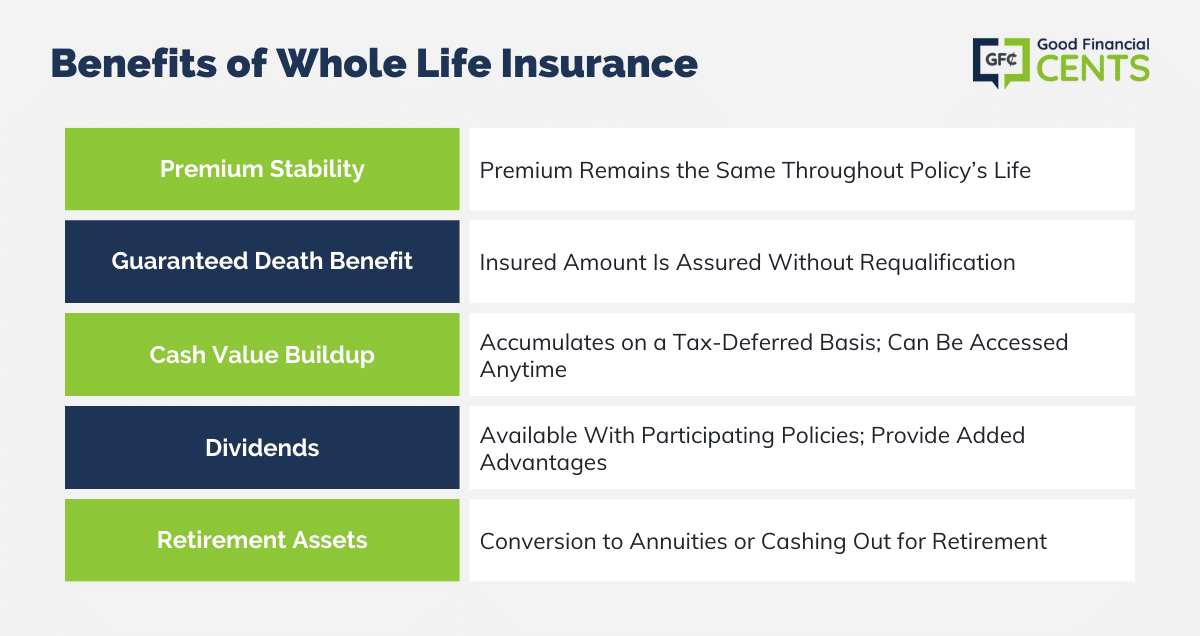

Under some plans, premiums are needed to be paid for an established number of years. Under various other policies, premiums are paid throughout the insurance holder's lifetime. The insurance provider spends the excess costs dollars This kind of policy, which is often called money value life insurance policy, creates a cost savings component. Cash worths are crucial to an irreversible life insurance policy.

Sometimes, there is no connection in between the dimension of the money worth and the costs paid. It is the money value of the policy that can be accessed while the insurance policy holder is to life. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the existing table made use of in computing minimal nonforfeiture worths and policy books for normal life insurance policy plans.

The 7-Minute Rule for Hsmb Advisory Llc

There are two basic groups of long-term insurance, typical and interest-sensitive, each with a number of variants. Standard entire life policies are based upon long-term price quotes of expense, passion and mortality.

If these price quotes change in later years, the business will certainly adjust the premium appropriately yet never over the optimum ensured costs stated in the policy (St Petersburg, FL Health Insurance). An economatic whole life policy gives for a basic amount of getting involved entire life insurance policy with an extra extra insurance coverage provided with making use of dividends

Since the costs are paid over a much shorter period of time, the premium repayments will certainly be greater than under the whole life plan. Single premium entire life is minimal settlement life where one large superior repayment is made. The plan is totally compensated and no more costs are called for.

An Unbiased View of Hsmb Advisory Llc

Since a considerable repayment is included, it ought to be seen as an investment-oriented product. Interest in solitary costs life insurance policy is mostly because of the tax-deferred treatment of the build-up of its cash worths. Tax obligations will certainly be incurred on the gain, nonetheless, when you surrender the policy. You may borrow on the cash worth of the policy, however keep in mind that you may sustain a substantial tax obligation costs when you give up, even if you have actually obtained out all the cash worth.

The advantage is that improvements in passion rates will be mirrored faster in interest delicate insurance policy than in typical; the disadvantage, certainly, is that decreases in rates of interest will likewise be felt quicker in passion sensitive entire life. https://pastebin.com/u/hsmbadvisory. St Petersburg, FL Life Insurance. There are four standard passion delicate whole life policies: The universal life policy is really greater than passion delicate as it is designed to reflect the insurance firm's current mortality and cost along with passion earnings rather than historic prices

More About Hsmb Advisory Llc

The business credit ratings your premiums to the cash money worth account. Regularly the company subtracts from the cash money worth account its costs and the price of insurance coverage security, typically referred to as the mortality deduction charge. The balance of the money value account builds up at the rate of interest credited. The company assures a minimal rate of interest and an optimum mortality cost.

These assurances are usually extremely conservative. Present presumptions are vital to passion sensitive items such as Universal Life. When rate of interest are high, advantage projections (such as money worth) are also high. When rate of interest are low, these estimates are not as attractive. Universal life is additionally the most versatile of all the numerous kinds of plans.

Things about Hsmb Advisory Llc

It is necessary that these presumptions be reasonable due to the fact that if they are not, you may have to pay more to maintain the plan from decreasing or lapsing. On the other hand, if your experience is much better after that the assumptions, than you may be able in the future to avoid Web Site a costs, to pay much less, or to have the strategy paid up at a very early day.

On the various other hand, if you pay even more, and your assumptions are sensible, it is feasible to pay up the policy at a very early day. If you give up a global life policy you might obtain less than the cash value account due to surrender costs which can be of two types.

Getting My Hsmb Advisory Llc To Work

Report this page